Historic Times Call for Creative Solutions

Historic Times Call for Creative Solutions

By Michael Merwin, SVP, Investment Management, and Keith Dyer, VP, Mortgage Acquisition & Relationship Management

We’re living in historic times for the housing market.

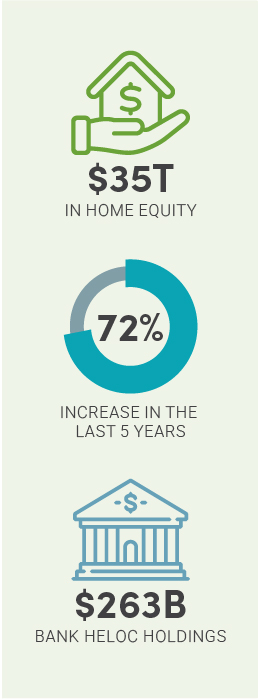

Soaring home values have allowed homeowners to grow an incredible amount of wealth very quickly. Collectively, American homeowners now hold $35T in home equity, a 72% increase in the last five years.

But the tricky thing about home values is that people need somewhere to live, and as long as they do, that equity stays locked in their home. It’s a significant untapped source of liquidity for regular people.

Meanwhile, U.S. commercial banks have a lot of their capital tied up — approximately $263 billion in home equity lines of credit (HELOC) alone, as of mid-2025 — and have a rising need for liquidity themselves. And thus arises a modern-day chicken or the egg: which comes first when consumers need cash and want HELOCs and banks want to issue HELOCs but need more cash? Where many might see a riddle, Cenlar saw an opportunity. Breaking the Mold Cenlar has made its reputation as mortgage subservicer, but unlike many of the large subservicers out there, we have an extra arrow in our quiver: a federally chartered and regulated commerical bank. That means we can be creative to provide better opportunities for our clients. At Cenlar, we’re relentless in our pursuit of being the best partner to our clients. We spend a lot of time talking with our clients about what keeps them up at night and how we might help them sleep more soundly. A lot of clients have been saying the same thing: they’d love to offer more products, especially HELOC products given the historically high amount of equity available in homes right now. And that’s why we decided to leverage the power of our commercial bank to deliver more value to them, starting with a loan acquisition conduit. Our acquisition conduit, where we purchase loans from our clients or perspective clients, allows our partners to be free from capital restraints, scaling quickly to keep their pipeline moving and their closings on track. It also takes some pressure off their balance sheet, further allowing them to stay focused on driving new business. We are starting with HELOCs, sourced through strategic partnerships, and can offer both bulk and flow execution options to meet a range of needs. We offer both servicing-retained and servicing-released structures, providing sellers the flexibility to either preserve servicing rights or fully transfer them—aligned with their strategic and operational goals. Simply put, it's a complementary product line that no one other than Cenlar can offer. |  |

Why Cenlar?

Unlike traditional lenders, Cenlar does not originate loans or offer retail banking services. Instead, our subservicing group specializes in all the operational things that happen after a loan has been originated, disciplines like loan boarding, payment processing, escrow management, customer support, delinquency management and investor reporting.

What we don’t and can’t do is cross-sell to our clients’ customers. We’re here to support our partners’ success—not to compete with them.

We’ve also expanded our team with deep expertise across banking, lending and asset management, and looking ahead, we plan to further diversify our bank products and assets—with the addition of Second Liens, Jumbos and Non-QM products.

What this means is you get to keep your hard-earned customer relationships while also getting quickly the capital you need to grow in the manner you need it, all while enjoying the added benefit of a partner and advisor whose sole interest is ensuring the success of your business.

In a market where you have to scrap for every victory, that’s the definition of a win-win-win.